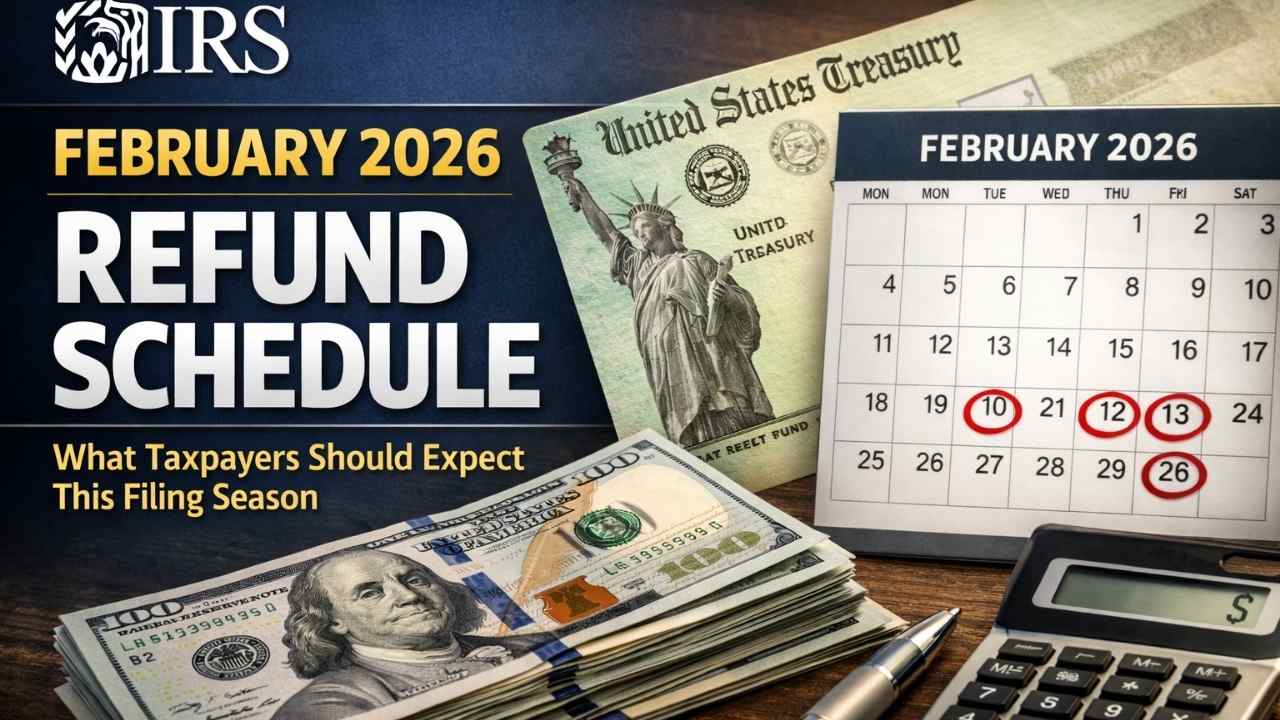

IRS February 2026 Refund Schedule: The February 2026 refund schedule from the Internal Revenue Service (IRS) is a major focus for taxpayers who filed early this season. For many Americans, a federal tax refund provides essential financial support at the start of the year.

The 2026 filing season opened in late January, and refunds are now being processed on a rolling basis. While most payments follow a predictable timeline, some returns may face delays due to legal requirements or verification checks.

Also Read: Social Security Trust Fund Crisis Explained: What Future Benefit Cuts Could Mean For Retirees

Understanding how the February refund cycle works can help taxpayers set realistic expectations and plan their finances accordingly.

How IRS Refund Processing Works

The IRS generally issues most refunds within 21 days of accepting an electronically filed return. This timeline applies mainly to taxpayers who choose direct deposit and submit accurate returns.

Refund timing depends on several factors:

Also Read: 2026 Tax Season Update: Bigger IRS Refunds Reported Amid Slower Filing Activity!

- Method of filing (e-file vs. paper)

- Payment method (direct deposit vs. check)

- Whether refundable credits are claimed

- Accuracy of income and dependent information

- IRS identity verification requirements

Paper-filed returns and mailed checks typically require additional processing time.

Estimated February 2026 Refund Schedule

The IRS does not publish a fixed refund calendar. However, based on standard processing patterns, the following table outlines expected refund windows for returns accepted during late January and February 2026.

Estimated IRS February 2026 Refund Timeline

Also Read: $2000 IRS Direct Deposit February 2026 Payment Dates Eligibility And Latest Official Updates

| Return Accepted Between | Direct Deposit Expected | Paper Check Expected |

|---|---|---|

| Jan 27 – Jan 31, 2026 | Feb 7 – Feb 14, 2026 | Feb 18 – Feb 25, 2026 |

| Feb 1 – Feb 7, 2026 | Feb 14 – Feb 21, 2026 | Feb 24 – Mar 2, 2026 |

| Feb 8 – Feb 14, 2026 | Feb 20 – Feb 28, 2026 | Mar 1 – Mar 8, 2026 |

| Feb 15 – Feb 21, 2026 | Feb 27 – Mar 6, 2026 | Mar 7 – Mar 14, 2026 |

| Feb 22 – Feb 28, 2026 | Mar 6 – Mar 13, 2026 | Mar 14 – Mar 20, 2026 |

| Mar 1 – Mar 7, 2026 | Mar 13 – Mar 20, 2026 | Mar 21 – Mar 28, 2026 |

| Mar 8 – Mar 14, 2026 | Mar 20 – Mar 27, 2026 | Mar 28 – Apr 4, 2026 |

These estimates assume no errors, no additional documentation requests, and no mandatory credit holds.

PATH Act and Credit-Related Delays

Taxpayers claiming certain refundable credits should expect additional waiting time.

Under federal compliance rules, refunds including:

Also Read: Federal Retirement COLA Guide: Protecting Purchasing Power Against Rising Inflation

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

cannot be released before mid-February.

Even if filed early, returns claiming these credits are typically processed toward the end of February or early March. This delay helps prevent fraud and ensures proper eligibility verification.

Common Reasons for Refund Delays

Not all refunds are issued within the standard 21-day timeframe. Several issues can extend processing:

Also Read: WIC Program 2026 Offers $52 Monthly Fruit and Vegetable Benefits

- Incorrect Social Security numbers

- Income mismatches between taxpayer and employer records

- Missing forms such as W-2 or 1099

- Identity verification notices

- Incorrect banking details for direct deposit

If the IRS flags a return for manual review, the refund timeline may extend beyond the typical processing window.

How to Track Your Refund

Taxpayers can monitor their refund status using the IRS online tool called Where’s My Refund?

The system typically shows three stages:

Also Read: New 2026 Social Security Checks Coming Soon What Beneficiaries Must Know About Payments

- Return Received

- Refund Approved

- Refund Sent

Electronic filers can usually check status within 24 to 48 hours after submission. Updates are made once daily.

Direct deposit remains the fastest option, while mailed checks may take one to two additional weeks after approval.

Financial Impact of February Refunds

February refunds play a significant role in household budgeting. Many taxpayers rely on refunds for:

Also Read: US Visa Waiver Program 2026 Latest Updates on ESTA and Eligibility

- Paying off credit card balances

- Covering rent or mortgage payments

- Catching up on utilities

- Building emergency savings

- Making necessary purchases

Knowing when funds are likely to arrive helps families avoid overextending their finances.

Steps to Receive Your Refund Faster

Taxpayers can improve processing speed by following these steps:

- File electronically instead of mailing paper returns

- Choose direct deposit instead of a paper check

- Review income documents carefully before filing

- Wait until all tax forms are received

- Respond promptly to any IRS correspondence

Accurate and complete filing significantly reduces the risk of delays.

Also Read: $2,000 Federal Deposits February 2026 Explained With Eligibility Rules, Timeline, and Latest Updates

Frequently Asked Questions

When will IRS refunds start arriving in February 2026?

Most early filers using direct deposit can expect refunds beginning in early to mid-February.

How long does it take to receive a refund?

The IRS generally issues most electronic refunds within about 21 days of acceptance.

Why is my refund taking longer than expected?

Delays may occur due to identity checks, credit-related holds, or filing errors.

Also Read: First-Time Home Buyer Grants 2026 Update: With $25,000 Down Payment Assistance Explained Clearly

Are EITC refunds released in early February?

No. Refunds that include EITC or ACTC are typically held until mid-February at the earliest.

Is direct deposit faster than a paper check?

Yes. Direct deposit usually arrives one to two weeks sooner.

Can filing early guarantee a faster refund?

Filing early helps, but accuracy and eligibility reviews also affect timing.

Also Read: $1,390 IRS Payment Rumor Explained: Truth, Eligibility Facts, and Latest Official Updates Today

Summary

The IRS February 2026 refund schedule follows standard processing timelines, with most direct deposit refunds issued within three weeks of return acceptance. However, mandatory holds for certain tax credits and common filing errors can extend wait times into late February or early March.

Taxpayers who file electronically, select direct deposit, and ensure accurate information are more likely to receive their refunds within the expected February window. Proper planning and realistic expectations can make the filing season smoother and less stressful.

Also Read: Truth About Medicare Giveback 2026 And The $174 Social Security Increase Explained Clearly

Dr Linda Steele is a Senior Lecturer at the Faculty of Law, University of Technology Sydney, and a member of the Law Health Justice Research Centre. She is also a Visiting Senior Fellow at the Faculty of Law, Humanities and the Arts, University of Wollongong.